You will see new fields in QBO after turning on the Multi-currency feature,. If you are going to make these adjustments, you should consult an accounting professional. The total unrealized gain or loss will show up in the row for each of these open transactions, so that you can easily see how all home currency adjustments affect each transaction. The report will regularly display the domestic currency despite the currency used in the transaction. Call 416.410-0750 or fill out the form below. To assign a new currency you need to create new profiles. You can create a new account by clicking on the New button. So, thats how a zero balance in a foreign currency can yield a non-zero balance on the balance sheet. what is home currency adjustment in quickbooks? Then you'll know which vendor(s) to enter in the Name column. Thats how much they would give me for it in the U.S. bank account, and so that was the exchange rate I used on this second transaction. For that kind of information, you would go back to the Revalue screen by clicking on the Gear icon > Currencies to get to the Currency list, and then in the Action column next to the Euro (or whatever foreign currency you want), click on the drop-down next to Edit currency exchange and then select Revalue currency.

You have to create new accounts for your foreign-currency transactions. 2. Click Save once the transaction has been completed. Shell tell you what the best steps are in order to maintain accurate multicurrency books in real time and to keep an eye on profitability and potential business issues before they are too far in the past to address and correct. But hold your horses. How Can Investors Protect Themselves From Cryptocurrency Volatility? Go through with these steps: After enabling the multi-currency option, youll find an option to display the Currencies list if you click the Gear button, the Currencies option appears at the bottom of the Lists section on the Gear menu. intuit. Update the currency exchange rate for the specific date/s, in the Edit Currency window. When you look at the chart of accounts, you will see a currency column, which displays the currency distributed to every account. When the Euro customer paid half of that, or 50,000, we expected to receive the equivalent of $113,714.50 USD divided by 2, or $56,857.25 USD. Now, lets get back to the Profit and Loss report.

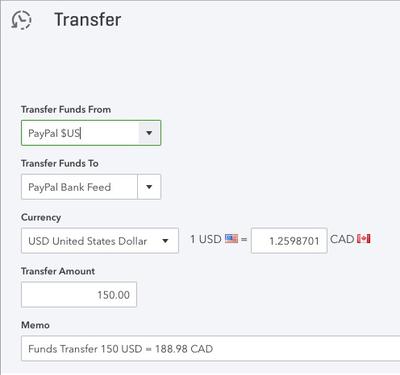

You will not be capable to choose multiple customers in the invoice for time and expense window. If a name is already listed using your home currency, give a slightly different name to the foreign-currency customer or seller you have created. This could be the difference between a black bottom line and a red one. But when they open the Home Currency Adjustment screen and specify the currency of that bank account, that closed bank account doesnt appear. The currency cannot be changed for names that already have transactions registered against them. If you toggle Yes, I use more than one currency radio button, you will see more than one currency radio. Under the Customer Center or Vendor Center option, choose the New Customer: job or New Vendor from the drop-down, then select New Customer or New Vendor. With the help of this feature, user can translate the foreign transactions in home currency and calculate gain or loss due to difference between exchange rates of foreign currency and home currency. Hello Avi -Sorry, that's the way QB worksdoing a transfer from one currency bank account to another does not trigger an exchange gain or loss. INR is my home currency. Choose Multiple Currencies from the left-hand menu. A course on Multicurrency in QuickBooks Online is next on her agenda. Euros, Pounds Sterling, Pesos, etc.) Ive seen lists of year-end adjusting entries that clients are supposed to enter into QuickBooks, and its clear that the accountants who created them dont understand QuickBooks. : this issue or error code is a known issue in Quickbooks Online (QBO) and/or Quickbooks. Instead of a regular journal entry that will mess with the foreign accounts reconciliation, I show my clients how to create a Home Currency Adjustment (in QuickBooks Desktop) or a Currency Revaluation (in QuickBooks Online). Sales and purchase both use home currency and foreign currency, QBO performs all the changes for you on screen. So, this is the main reason QuickBooks multi-currency feature arrives in the business. The currency you choose will determine your choice. This was QBDT 2019, by the way. After doing this, the Canadian Bank Accounts balance in Canadian dollars is still $0.00, but its home currency value now also is correct at $0.00 (US). First, let me explain how a zero balance foreign bank account with a non-zero home currency value can happen. And what about my Freedonian building? QBO informs you with the following points while turning on the Multicurrency feature: Choose I Understand I Cant Undo Multicurrency. In fact, let me do that. Choose the US Dollar from the drop-down menu. Its one in which the debits or credits affected the foreign accounts (even multiple A/R customers and A/P vendors in one transaction, normally not possible in QuickBooks Desktop). There is much more to this story. Did you go into Enter Bills / Pay Bills and follow the proper A/P workflow? What is a home currency adjustment? If it's more than one vendor, you will have to do this in more than one entry. Youll see that there are two accounts in this journal entry with non-zero figures: The Euro Chequing and the Eiffel Tower at Cost accounts. They were looking to enter $0.00 in the Balance (USD) column. Some might see this $0.00 journal entry and be tempted to delete it. Use your foreign-currency customers or sellers for any new sales or purchases you have made, but continue to use domestic currency names until you complete any open transactions. Click to Advanced. Please enter the following information: (Optional). So, go through the article to learn different steps to set up multi-currency features in QBO & QBD. First try to resolve the issue yourself by looking for a resolution described below.

When you look at the bank and credit card registers, the currency of each transaction appears in parentheses in the Payment, Deposit, Sales Tax, and Balance Payable columns. Go to Company > Manage Currency > Home Currency Adjustment.Select the currency from the drop down list and enter the exchange rate (equal to exchange rate in Step 1). Im partial to all things Canadian (gee, I wonder why), so lets call it a Canadian Bank Account. The posting affects Exchange Gain or Loss. Save my name, email, and website in this browser for the next time I comment. how do i change home currency in quickbooks desktop? Experts are available to resolve your Quickbooks issue to ensure minimal downtime and continue running your business. You can edit the Currency column by clicking the edit button at the top. Powered by, Navigate to the Currency Centre by clicking the, Select the drop down on the currency you wish to perform the adjustment and click. Instead, consult with Esther Friedberg Karp for multicurrency consulting. If you want to use this transaction only or all new transactions in (currency) for (date), select Use for this transaction only. Intuit Data Protect: How to Install Updates to Backup QuickBooks Files, Steps to Enable Multi-Currency in QuickBooks Desktop, Step 2: Add foreign-currency customers and vendors, Step 5: Create foreign-currency transactions, Steps to Enable Multi-Currency in QuickBooks Online, How the Multi-currency feature changes QBO, Steps to Turn On the Multicurrency featureOther Useful Resources:Steps to Turn On the Multicurrency feature, QuickBooks Online Training Program 2022: For Individuals & Small Firms, Resolve data damage to your QuickBooks Mac Desktop Company File, How to Return QuickBooks products for a refund, Activating the multi-currency feature will not affect QuickBooks desktop add-ons, like, You will not be capable to use Insights, Income Tracker, and Bill Tracker. I have bank accounts with USD and INR. The Transactions pane will appear on your left. They specified the valuation date (Dec.31, 2016) and the currency (Canadian dollar). Intuit QuickBooks discovered a dynamite multi-currency function in 2009 available in the windows version. Note: The currency of A / R and A / P accounts need to meet with the currency of the buyer or seller used in the transaction. Hello Michael - Thats because A/P and A/R are supposed to take the differential in the home currency (when theres a change in the exchange rate) and put it to Exchange Gain or Loss when the bill or invoice is paid. We can not guarantee such an answer, nor provide any time frame in which any such answer might be provided, if one is in fact provided. Terms and conditions, features, support, pricing, and service options subject to change without notice. Privacy Policy. Use chart accounts to generate foreign currency bank and, Start QuickBooks and select Lists menu, later click on. Copyright 2022 WizXpertDisclaimer|Privacy|Terms & conditions|Refund policy, 394 Judith Basin County, Stanford, MT 59479 USA, Here in this article, we are describing how to set up and use of Multi-Currency feature in, Through QuickBooks Multi-Currency feature you can, QuickBooks Desktop Enterprise 2022 - Plan, Pricing & Feature, Invoice Past Due Stamp Feature in QuickBooks 2018 Desktop, QuickBooks Desktop New Cash-Accrual Report feature & Cash vs Accrual Accounting, How To Use QuickBooks Desktop On Two Computers (QuickBooks Multi-User Setup), How to Set up & Activate QuickBooks Direct Deposit Feature in QuickBooks Payroll. In fact, the Canadian dollar was worth $0.7448 (USD), according to the U.S. bank account to which I transferred the funds on Dec.31, 2016. Our team will give your business the right support that it needs to eliminate errors, ensure success and save some serious money. If proper workflows were followed in entering and paying the bill, you should not have had an outstanding home currency value to adjust if the foreign amount was zero. If youve ever created a Home Currency Adjustment in the conventional way, you could see that, behind the scenes, it created a very specific type of General Journal Entry. Still, having any issue contact our QuickBooks ProAdvisor toll-free:+1-844-405-0904. All Rights Reserved. Despite the fact that the balance in a closed bank account is obviously zero (in any currency), a non-zero home currency balance (either positive or negative) appears for that account on their QuickBooks Balance Sheet. Drill down on foreign A/R and group by Customer. If it is a complex issue or you are unable to solve the issue, you may contact us by clicking here or by using other support options.

- Saferacks Storage Bin Rack

- 8 Inch Round Butterfly Damper

- Weleda Citrus Body Lotion

- Public Desire Half Size

- Best Electric Golf Push Cart For Hills

- Apple Germany Refurbished